Volunteers

Join us!

Join Us & Get Involved!

Winter 2026 applications are now closed! However, we will be recruiting in Fall 2026, so keep an eye out for our next recruitment cycle if you are interested in volunteering with VITA.

Please note that we are only able to recruit from the UCLA student body, either undergraduate and graduate students. Unfortunately, we are currently unable to accept UCLA Extension students due to UCLA policy.

Our returning volunteer application period for the 2025–2026 academic year has now closed. If you missed the deadline or have any questions, please contact vitauclavolunteer@gmail.com for more information.

If you have any questions, feel free to email vitauclavolunteer@gmail.com.

The Fall 2025 Application and Returners’ Interest Form are now open!

They will be due Saturday, October 4th, at 11:59 PM PT. Please apply if you are interested in volunteering with VITA at UCLA. If you are returner, you have until Saturday, October 11th, at 11:59 PM PT.

Join us for our info session on Wednesday, October 1st (Week 1), at 6:00 PM PT in Royce Hall 362 to learn more.

Please note that we are only able to recruit from the UCLA student body. Unfortunately, we are currently unable to accept UCLA Extension students due to UCLA policy.

Fall cohort training sessions begin in Week 2. There will be two in-person training session dates/options to choose from: Wednesdays from 6:00PM – 7:50PM and Sundays from 5:00PM – 6:50PM.

In addition, VITA will be hosting a Networking Night on Thursday, October 23rd, from 7:00 – 8:00 PM PT in Ackerman Grand Ballroom, featuring firms such as PwC, KPMG, Baker Tilly, and more—a great opportunity to connect with professionals in the accounting industry. Volunteers will also enjoy an exclusive VITA-only hour from 6:00 – 7:00 PM PT before the event opens to the general UCLA community. RSVP by October 16th to secure your spot!

If you are a returning volunteer and would like to join us for the 2025-2026 academic year and 2026 tax season, please complete the returner’s interest form below by Saturday, October 11th, at 11:59 PM PT.

If you have any questions, feel free to email vitauclavolunteer@gmail.com.

We look forward to reviewing your application!

The Winter 2026 Application is now open!

Applications are due Thursday, January 8, 2026, at 11:59 PM PT. Please apply if you are interested in volunteering with VITA at UCLA.

Join us for our info session on Wednesday, January 7th (Week 1), at 6:00 PM PT in Mathematical Sciences 4000A to learn more.

Please note that we are only able to recruit from the UCLA student body. Unfortunately, we are currently unable to accept UCLA Extension students due to UCLA policy.

Winter cohort training sessions begin in Week 3. Mandatory in-person training sessions will take place on Wednesdays from 6:00PM – 7:50PM (Math Sciences 4000A) during Winter Quarter Weeks 3-7.

If you have any questions, feel free to email vitauclavolunteer@gmail.com.

We look forward to reviewing your application!

Why Join?

Recruitment Timeline

VITA hosts two recruiting cycles each academic year, during the Fall and Winter Quarters. All majors and backgrounds are encourages to apply.

If you have any questions, feel free to email vitauclavolunteer@gmail.com.

Winter 2026

Applications Due

Thursday, Jan. 8th

11:59PM PT

Make sure to submit your application by the deadline above through our Google Form, linked below. Scroll down for more information.

Fall 2025

Enormous Activities Fair

Monday, Sept. 22nd

11:00AM-2:00PM PT

Check us out at the UCLA Enormous Activities Fair explore your interests in taxes and passions in volunteering. Learn how you can be a part of VITA by visiting us at our booth!

Info Session

Wednesday, Oct. 1st

6:00PM-8:00PM PT

Join us at our info session to learn more about the recruitment and training process, explore opportunities in accounting and taxes, and speak with our board members about their experience with VITA.

Applications Due

Saturday, Oct. 4th

11:59PM PT

Make sure to submit your application by the deadline above through our Google Form, linked below. Scroll down for more information.

Applications will be released by Monday, October 6, 2025 before 11:59PM!

Volunteer Overview

VITA opens volunteer applications for UCLA students at the beginning of the Fall and Winter quarters. Prior experience in tax preparing is not required and all majors are welcome to apply!

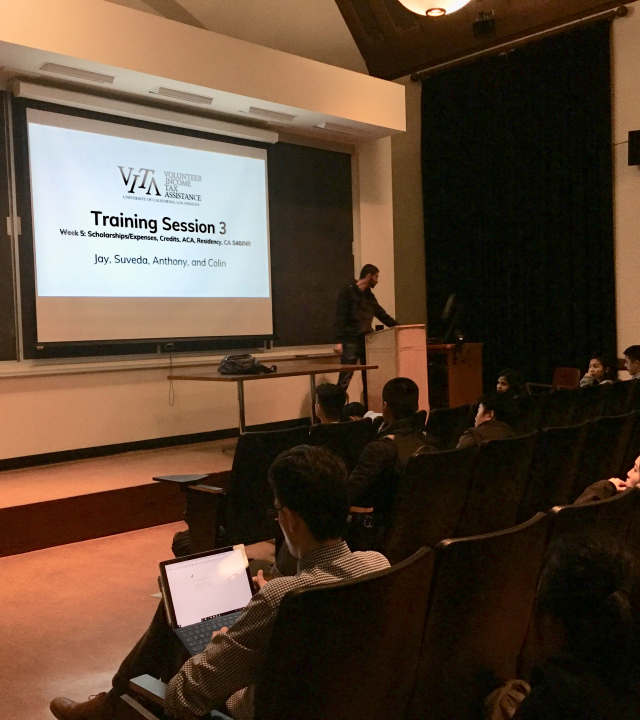

Volunteers will be equipped to file tax returns through extensive, interactive training sessions. Volunteers will learn about general tax concepts and tax situations for low-income, international, and elderly clients. Additionally, training sessions will include tax client simulations in order to train volunteers for client interactions.

- For Fall volunteers, 6 training sessions will take place from Weeks 2 to 7 (no training on week 8)

- For Winter volunteers, 5 training sessions will take place from Weeks 3 to 7

Tax sites will last from the end of January to mid-April.

Training Information

For Fall Quarter, mandatory weekly training sessions will take place in person in Royce Hall 362 on Wednesdays from 6:00 – 7:50 PM PT and in Ackerman Viewpoint Conference Room on Sundays from 5:00 – 6:50 PM PT, with office hours after each training session!

Please note that you only have to attend one of the two training session options each week and that attendance will be taken at which ever one you choose.

For Winter Quarter, mandatory weekly training sessions will take place in person on Wednesdays from 6:00 – 7:50 PM PT in Mathematical Sciences 4000A, with office hours after each training session!

Please check the Volunteer Portal for meeting links and additional volunteer resources.

Frequently Asked Questions

Recruitment

No worries! Prior experience in taxes is not required at all. We provide you all the necessary training during Fall or Winter quarter.

No — we accept all majors and minors!

We do not have a maximum cap for volunteers. If you are passionate about service and interested in learning more about taxes, we want you!

Fall cohort volunteers are required to attend mandatory training sessions each week in the Fall Quarter and Winter Quarter and complete weekly assignments (approx. 2 hours/week), as well as take the IRS certification exams during the Winter Break (approx. 2-5 hours).

Winter cohort volunteers are required to attend mandatory training sessions each week in the Winter Quarter and complete weekly assignments (approx. 2-3 hours/week), as well as take the IRS certification exams at the end of the Winter Quarter (approx. 2-5 hours).

All volunteers are required to volunteer throughout the tax season in the Winter Quarter and Spring Quarter, from mid-January to mid-April (approx. 2-4 hours/week).

We also host various social and professional development events during training sessions and throughout the year for volunteers to attend.

Training

This year, we will conduct mandatory in-person training for the Fall Quarter on Wednesdays from 6:00 – 7:50 PM PT at Royce Hall 362 and Sundays from 5:00 – 6:50 PM PT at Ackerman Viewpoint Conference Room. Please note that you only need to attend one of the two sessions each week. We will conduct mandatory in-person training for the Winter Quarter on Wednesdays from 6:00 – 7:50 PM PT. Training sessions for Winter Quarter will be held in Mathematical Sciences 4000A.

Training sessions are mandatory to attend, and attendance will be marked. Training presentation slides and other resources will be posted on the Volunteer Portal.

We require new volunteers to attend the mandatory in-person training sessions. Participation will be credited through attendance quizzes at the end of each training session. Additionally, volunteers will be required to complete weekly quizzes that recap the past week’s material and must earn an average of 70% overall. Additionally, volunteers must take and pass the IRS certification exams prior to handling any tax returns from clients.

Returning volunteers are strongly encouraged (but not required) to attend these new volunteer training sessions to review tax material. However, returning volunteers are required to participate in the returning volunteer training session in Week 7, on Wednesday, November 12th, from 6:00PM – 7:50PM in Royce Hall 362 OR Sunday, November 16th, from 5:00PM – 6:50PM in Ackerman Viewpoint Conference Room.

Yes, we will post all of our training materials online for review shortly before the training date. Please check your emails and the Volunteer Portal for updates!

Note: Training sessions will NOT be recorded. In-person attendance is mandatory.

Quality Reviewer

A Quality Reviewer’s job is to audit a volunteer’s tax return for accuracy. After a volunteer completes a tax return, a QR is required to review the return for inconsistencies or missing information.

To become a QR, you must be a current volunteer and pass the Advanced and Foreign Student IRS VITA Certification tests. QR interest forms will be sent out to our official volunteers through email sometime in the Fall Quarter (around early November).

Tax Site

VITA at UCLA operations remain fully in-person for the 2026 tax season. If COVID-19 guidelines change well into the tax season and require us to transition to remote services, volunteers will provide tax preparation services via privacy-secured video conferencing software and scheduling platforms.